Who can claim Exempt on Federal W-4 Form

If an employee qualifies for exemption from withholding, the employee can use Form W-4 to tell the employer not to deduct any federal income tax from wages. This applies only to income tax, not to Social Security or Medicare tax.

You may claim exemption from withholding for this year if you meet both of the following conditions in # 1 and 2:

1. You had no federal income tax liability last year

-

- For the prior year, you had a right to a refund of all federal income tax withheld because you had no tax liability

- Your total tax on line 24 on last year’s Form 1040 or 1040-SR is zero (or less than the sum of lines 27, 28, and 29), or

- You were not required to file a return because your income was below the filing threshold for your correct filing status. Learn More.

2. You expect to have no federal income tax liability this year.

For employees claiming exemption from withholding, please note the following:

- A Form W-4 claiming exemption from withholding is valid only for the calendar year in which it is filed with the employer

- To continue to be exempt from withholding in the next year, an employee must provide a new Form W-4 claiming exempt status by February 15th of that year

-

- If your Form W-4 is not updated by February 15, as required by IRS guidelines your tax withholding status will be changed to “single” with zero allowances until you submit an updated Form W-4

- Tax refunds will not be made for failure to update your Form W-4 in a timely manner

How to Indicate Exempt on Federal W-4 Form

To claim exemption from withholding:

- Certify that you meet both of the conditions from the previous section by writing “Exempt” on Form W-4 in the space below Step 4(c).

- Then, complete Steps 1(a), 1(b), and 5. Do not complete any other steps. Completing the form incorrectly will cause us to have to deduct taxes using the default rate.

- You will need to submit a new Form W-4 by February 15 of the following year to be exempt from withholding in the next year.

-

-

- This date is delayed until the next business day if it falls on a Saturday, Sunday, or legal holiday.

- If the new Form W-4 is not provided, we will withhold tax at the default rate (single or married filing separately with no other entries in step 2, 3, and 4).

-

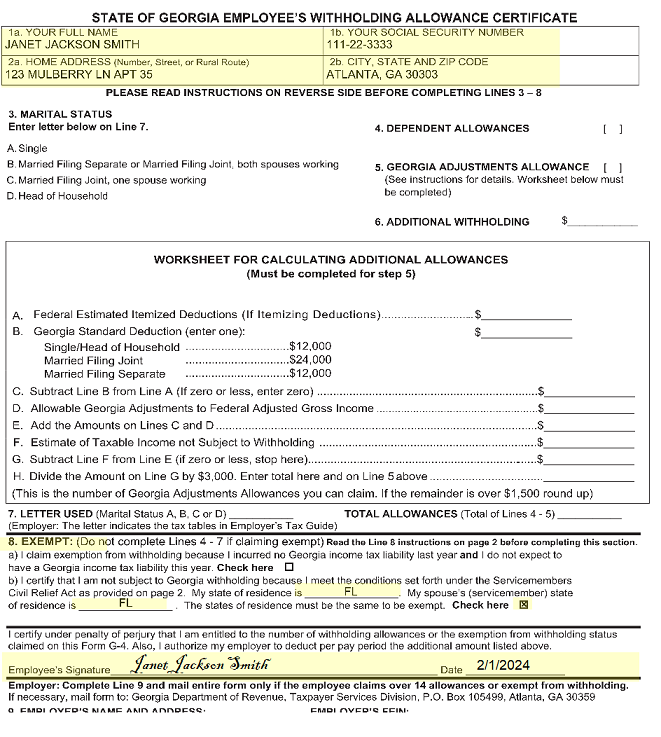

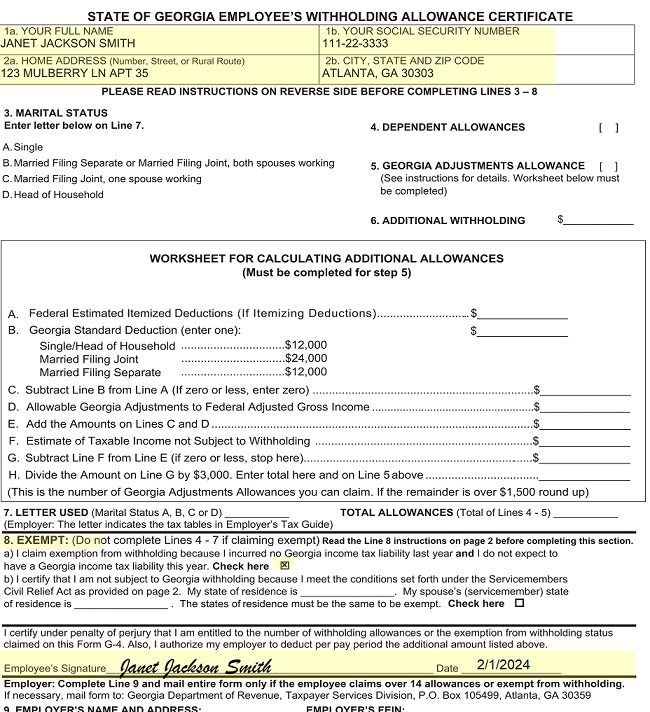

How to Indicate Exempt on State G-4 Form

We are unable to accept an exempt request where any information is entered onto lines 4 to 7.

The instructions and criteria for filing exempt are contained on the G-4 form. Only fill out name, address, SSN. Read options a & b of Question 8 carefully and then, if one of those options applies to you, check the appropriate box for that option. We cannot honor a request for exempt status if the form is not filled out properly. If you make a mistake or fill out a section that should not be filled out, please request a new form.

The bottom part that asks for employer info should already be filled in with Caring Hands United Inc’s Corporate address and identifying information, but if not, don’t guess, as filling in the wrong information will make the form invalid/unusable.

View example image of a properly completed Exempt form (with reason a – no tax liability)

When selecting reason A from Question 8, check the box that corresponds with part A. Sign and date the form. The picture below has the necessary fields highlighted.

View example image of a properly completed Exempt form (with reason b – military spouse)

When selecting reason B from Question 8, you must enter your state and your spouse’s current state. The states must be the same for the request to be valid. Then check the box that corresponds with part B. Sign and date the form. The picture below has the necessary fields highlighted.